The U.S. Has Entered a New Energy Era

Randy Wolken, President & CEO

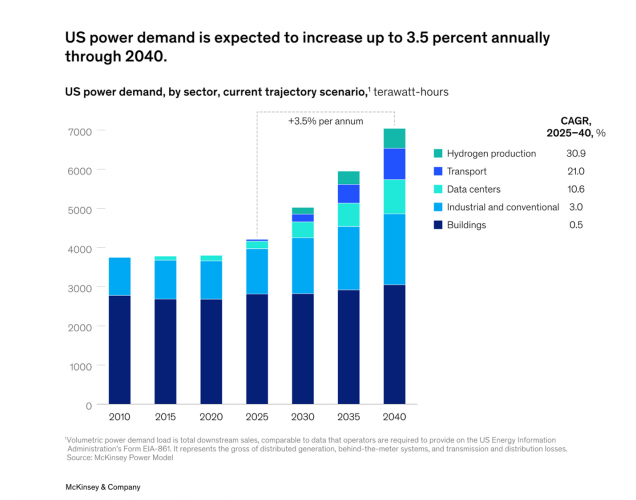

The U.S. is in a new age of energy. Over the past four years, new energy demands have reshaped the industry, with the most significant factors being reindustrialization, artificial intelligence (AI) deployment, data centers, and electrification. This has led to a period of sustained load growth for the first time in nearly two decades. Beyond that, power demand is expected to increase by more than three percent annually through 2040 and beyond.

For the U.S. to achieve energy abundance and maintain global leadership, the nation’s power system will need to be equipped to address this rising demand; an “all of the above” approach to energy will be required. A core part of the solution will come from a rapid and sustained build-out to grow baseload and dispatchable generation in order to increase grid capacity, according to the U.S. Department of Energy.

As energy operators and policy leaders work to meet rapidly increasing demands, power generation is the primary bottleneck. McKinsey Research has identified six key challenges the American energy sector must tackle to deliver critical assets:

- Resource adequacy: Many markets could face a shortage of supply as soon as 2030. According to McKinsey’s GEP Power Model, many U.S. grid operators could experience shortages of dispatchable power during peak summer demand hours by 2030. This is due to several factors including scheduled coal and gas retirements, a lack of market incentives to bring on new baseload and dispatchable generation, and supply chain challenges that are resulting in multi-year lead times for equipment.

- Extreme weather: Severe weather is the leading cause of U.S. power outages today. It affects physical infrastructure and often increases power demand, leading to reduced reserve margins at best and a resource adequacy crisis at worst.

- Energy-supply-chain issues: Orders of critical equipment face lead times of two to five years, or longer, while new-project timelines face delays due to limited upstream capacity for equipment such as transformers and turbines.

- Project permit bottlenecks: Energy projects are typically a multi-year process. For federal permits, project developers report the National Environmental Policy Act (NEPA) review—usually the key milestone for energy projects—as the primary bottleneck. These uncertain permitting timelines can impact project economics, resulting in higher project costs, delayed revenue, and a loss of competitive edge. The median review timeline is about three years, with some reviews taking much longer.

- Labor availability: Shortages in critical trades are imminent. The projected annual hiring for critical trades, such as welders, construction laborers, and electricians, through 2032 is expected to be more than 20 times the projected nationwide yearly increase in net new jobs. These labor constraints are especially challenging for the energy sector. For example, project developers report that engineering, procurement, and construction labor availability, pricing, and capacity are among their top challenges when building new assets, while upstream equipment manufacturers report similar constraints when scaling new capacity.

- Energy affordability: Growing costs are challenging investment ability. Since 2020, retail electricity bills have increased by around six percent yearly, a rapid increase compared to the previous 15 years. This dynamic has led to increased scrutiny from regulators on rate cases, and growing concerns from investors over the tension between affordability and returns. We expect this dynamic to continue challenging the sector over the coming years as more projects and increased capital spending become essential to keeping up with the growing electricity demand.

New York State has seen a similar increase in energy demand. In next week’s post, I’ll highlight our state’s challenge with meeting the growing need for increased high-quality energy and how it impacts the future of manufacturing investment and growth.