Recent Surveys Highlight Challenges Ahead

Randy Wolken, President & CEO

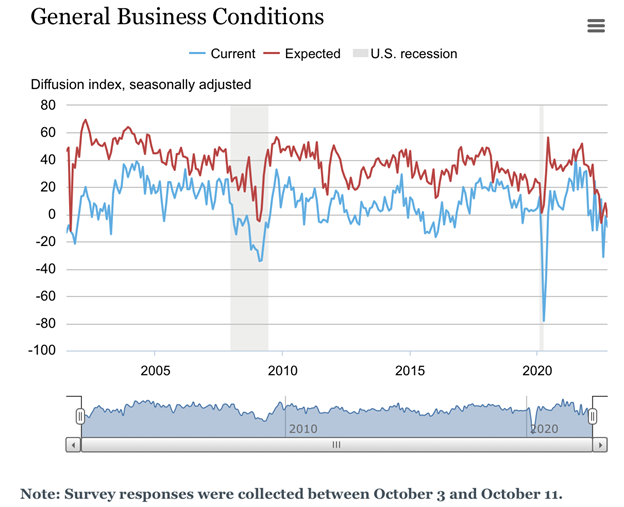

Two recent surveys highlight the challenges to manufacturers and businesses in the months ahead. First, the Federal Reserve Bank of New York released its October report. This survey of manufacturing businesses in New York State gives a good indication of what they are experiencing now and what they foresee in the future.

Business activity declined modestly in New York State from the prior month while the general business conditions index fell. New orders, unfilled orders, and shipments remained little changed from last month. Delivery times held steady, and inventories inched higher. Labor market indicators showed a slight employment increase and average workweek. However, input price increases picked up, and the pace of selling price increases held steady. Firms don’t expect business conditions to improve meaningfully over the next six months.

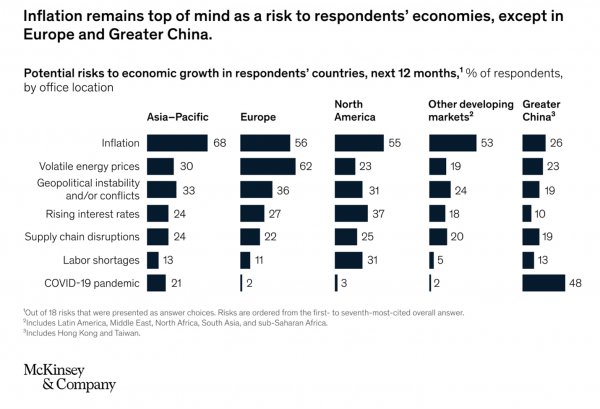

McKinsey surveys worldwide business leaders quarterly to determine what they are experiencing in their industry sectors. It can be a good gauge of what industries are seeing now and what they expect going forward. McKinsey released its September survey and reported on global business outlooks from multiple regions. Its respondents voiced concerns about supply chain disruptions but indicated domestic economic risks have diminished since the previous survey. Supply chain challenges are now the fifth-most-cited risk to respondents’ home economies, which surpassed concerns about rising interest rates.

Inflation remains the most-cited risk to domestic economies for the second quarter, followed by volatile energy prices, geopolitical instability, and conflicts. Inflation is the most-cited threat to respondents’ economies in all locations but Europe and Greater China over the next 12 months. In Europe, volatile energy prices and inflation are the most frequently cited growth risks, with geopolitical instability or conflicts a more distant third. In Greater China, the COVID-19 pandemic remains the most reported risk, cited by nearly half of respondents for the second quarter in a row.

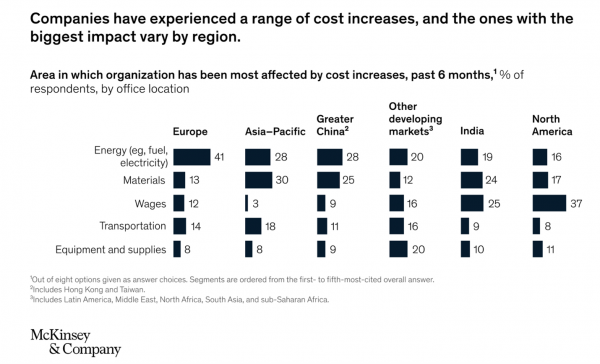

The concerns over various types of cost increases vary by region. In Europe, respondents primarily point to rising energy costs, whereas wage increases are of top concern in India and North America. However, consistent across all regions, respondents say their companies have raised their prices for products or services in the past six months. Looking ahead, 71 percent of respondents expect their companies’ operating expenses to be greater next year than last year.

Hopefully, these insights will be helpful to you as you consider the year ahead. Do let us know how we can help you be more successful. The MACNY team is ready to help in any way we can. And we remain grateful for all you do for our community.