Will We Have A Recession?

Randy Wolken, President & CEO

The economic question of the day is whether or not we will have a recession. It’s best to start with a definition of recession and go from there. As you will see, it is not easy to assess what a recession is, how we will know if we’re in one, and when it will end. And, following COVID-19 and its impacts, this recession, if we have one, may be very different.

A recession is defined differently depending on the entity you listen to. There is no official, globally recognized definition of a recession. In 1974, US economist Julius Shiskin described a recession as “two consecutive quarters of declining growth.” This is often used to determine when a country enters a recession. However, the US has since opted to use a more open definition. The National Bureau of Economic Research (NBER) looks at various factors when deciding whether or not America is in recession. The institution defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in production, employment, real income, and other indicators. A recession begins when the economy reaches a peak of activity and ends when it reaches its trough.”

The definition of a global recession is different. A consensus on the definition of a worldwide recession has yet to be reached. The World Bank’s primary indicator of a global downturn is multiple major countries’ economies contracting at the same time, as well as other evidence of weak global economic growth. The world economy has undergone four major downturns over the past seven decades: 1975, 1982, 1991, and 2009. According to the International Monetary Fund, recessions typically last for about a year in advanced economies.

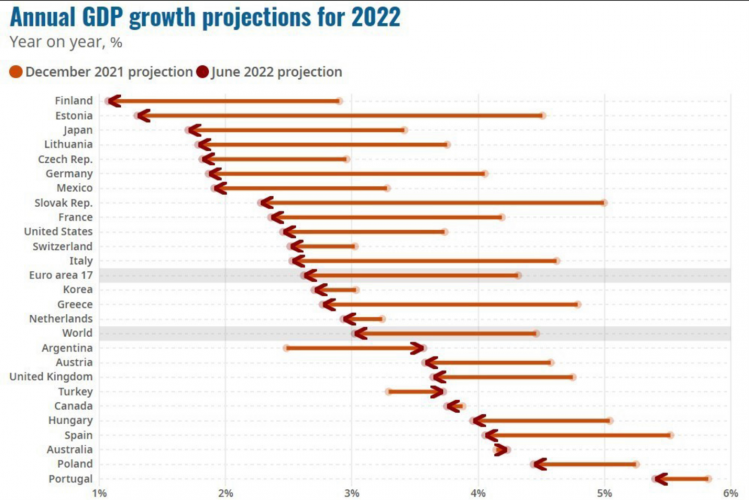

Nevertheless, significant changes in the projected GDP growth in many countries point to an emerging threat of a global recessionary period. The challenge with predicting a recession is we only know when we are in one after we have entered it. At least one prominent economist, Jason Furman, Harvard economist and economic advisor to the White House under Barack Obama, believes in less than a 50% chance of a recession.

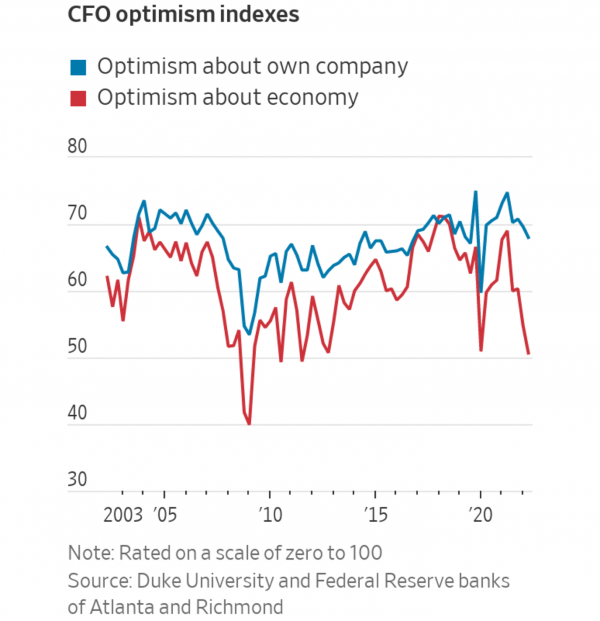

“The economic signals are really unclear,” Furman said, adding that even if everyone seems to be worried about a recession, behaviors have yet to reflect these concerns. “In the first half of the year, it looks like GDP fell. But jobs grew quite a lot. You have business leaders saying they’re worried we’re going to go into recession, but they’re still hiring people. If they’re bankers, they’re still making loans to people. You have consumers saying they’re really negative about the economy, but they’re still spending money,” Furman said. “It’s hard to square these contradictory signals right now,” he added.

For now, I am recommending every organization prepare for what they will do in a recession. However, that does not mean we will actually enter one this year. In a survey of CFOs nationally, most reported that they expect a recession – but that their company will be doing well.

Of course, if this holds true for many companies, a recession may be averted or mild when it arrives. This is my sincere hope. I also believe that the downturn may be different by region and state. We must do all we can to sustain a growing economy here in New York. At MACNY, we will be doing our part to support you daily – just like we have for the last 109 years.

Sources: