Reshoring And Nearshoring Accelerate

Randy Wolken, President & CEO

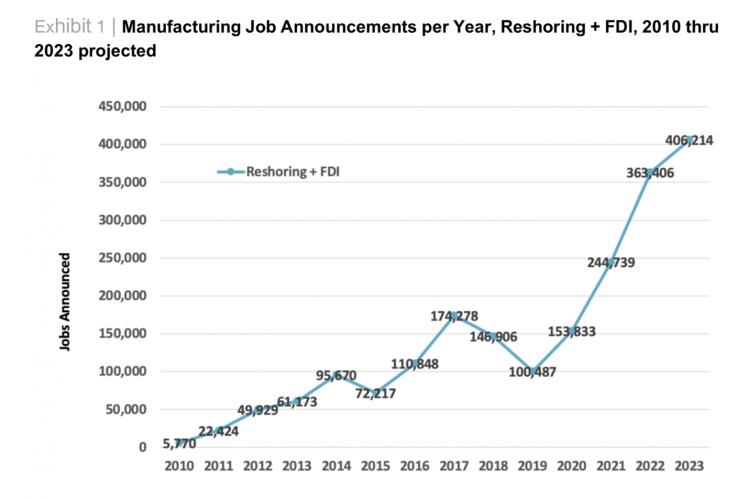

Last year the predicted trends of reshoring and nearshoring materialized. Reshoring and direct foreign investments related to manufacturing job announcements continued to outpace recent records, adding 101,500 jobs in 2023 Q1. New job announcements will reach over 400,000 by year-end if the current rate continues. Additionally, the cumulative number of jobs brought back since the manufacturing low in 2010 will reach two million – about 40% of what we lost to offshoring. These numbers speak to the enormous potential of reshoring that lies ahead. MACNY believes this is just the tip of the iceberg.

As reshoring continues to grow, the U.S. will see significant opportunities to export to the rest of the world. The U.S. is known worldwide for high-quality, innovative goods and services, customer service, and sound business practices. In December 2021, U.S. exports stood at a record high of $228.1 billion. On top of this, the U.S. was ranked as the second largest exporter in 2022, with approximately $2 trillion in goods and services exported annually.

According to a new post from Luis Torres, a senior business economist at the Federal Reserve Bank of Dallas, Mexico has again become America’s top trading partner, with $263 billion worth of goods passing between the two countries in the first four months of this year. Trade with Mexico accounted for 15.4% of goods exported and imported by the U.S., just ahead of America’s trade totals with Canada and China, which were 15.2% and 12%, respectively.

Nearshoring increased during the pandemic because of the increased cost of shipping products across the Pacific and the consumer demand for faster delivery times. Even as the world moves on from the pandemic, Mexico’s ability to take the top spot away from China — which has spent the last two decades attempting to integrate itself further into the U.S. economy — is a sign of how the economic chaos of 2020 will continue to define the world economy for years to come. This will bode well for NYS and U.S. firms from now on.

And finally, business activity held steady in New York State, according to firms responding to the July 2023 Empire State Manufacturing Survey. The headline general business conditions index fell slightly, but new orders increased, and shipments expanded. Delivery times were shortened, and inventories continued to decline. Employment levels edged higher, though the average workweek was little changed. Input and selling price increases continued to moderate. Planned increases in capital spending remained weak. Looking ahead, while firms expect conditions to improve, optimism remains muted.