Global Business Leaders Express Concern

Randy Wolken, President & CEO

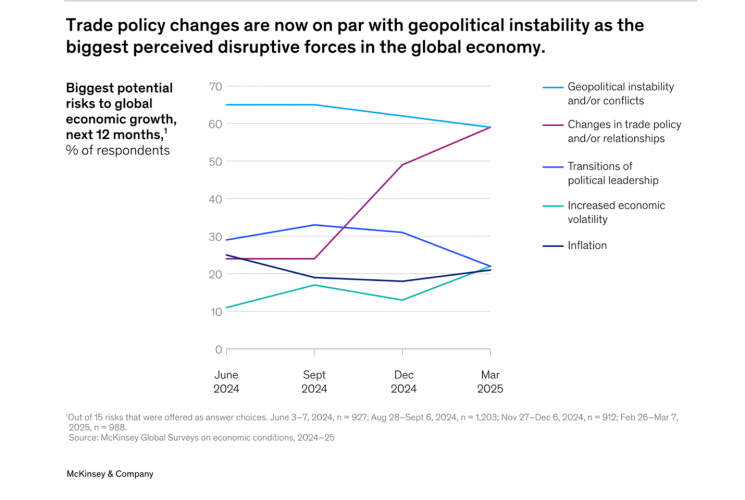

Much has changed in the last three months. In the December quarterly update of the McKinsey Global Survey on economic conditions, respondents’ expectations for the global economy were mainly stable from the previous quarter, and leaning more positive than negative. Policy shifts and uncertainty dominate the view of the economy in the latest survey. Respondents are now equally likely to see geopolitical instability and changes in trade policy relationships as disruptive forces, both in their own country and in the larger world economy. Consequently, respondents reported increasingly cautious views this quarter compared to last quarter on nearly every measure. They’re much more likely now compared to December to say economic conditions—both globally and in their own countries—will decline. However, views differ between respondents in emerging and developed economies. Respondents also reported that they’re less likely to expect their organizations’ performance to improve in the months ahead, when compared to recent years.

Over the past year, fewer respondents have reported improvement in global economic conditions. For the first time since March 2023, the percentage of respondents saying conditions are worse than six months ago is larger than the percentage reporting improvement. Similarly, when asked about their own countries, about one-third of respondents said conditions have improved, which is the smallest share since September 2020.

Geopolitics are top of mind as a potential disruption to companies’ performance. For the first time since March 2022, private sector respondents view geopolitical instability and conflicts as the most likely risk to companies’ growth. Geopolitical instability has overtaken weak demand—which for the last three quarters was the most-cited risk—as the most cited disruption, followed closely by changes in the trade environment and trade relationships. The percentage of respondents citing changes in trade as one of the most significant risks to company performance over the next 12 months has nearly doubled from six months ago.

However, some respondents see potential disruptions in trade as more of an opportunity than a risk for their companies. 23% say potential trade and trade policy disruptions are more of an opportunity, while 27% see the opportunity and risk as equivalent. Respondents in North America and Europe were more likely to view trade changes as a risk. In contrast, respondents in Greater China were much more likely to view it as an opportunity for their organizations.